New

Turn Your DMs Into Lead Gen!

Learn how to collect lead data from your DMs such as email addresses, phone numbers, and more right from your social inbox. If you are not yet automating your DMs your competitors are outpacing you.

How Something Social Saved 75% of Their Time and Increased Revenue by 15%

See how a fast-growing agency improved operations, cut down hours of manual work, and unlocked new revenue opportunities with Vista Social.

New

50 Unique Social Media Ideas for Consistent Content Creation

Discover 50 unique social media post ideas to engage your audience, grow your brand, and maintain a consistent content strategy with ease!

Mastering Content Reuse: The Key to a Consistent and Sustainable Posting Strategy

Summarize with AI

ChatGPT

Claude

Perplexity

Share

Vista Social

X (Twitter)

Table of contents

Summarize with AI

ChatGPT

Claude

Perplexity

Share

Vista Social

X (Twitter)

Instagram isn’t just a photo-sharing app anymore. In 2026, it’s where 3 billion people discover brands, shop for products, and spend nearly half their social media time watching Reels.

It’s where nano-influencers drive higher engagement than celebrities. Where businesses generate billions in direct sales. Where your competitors are already showing up every single day.

Whether you’re trying to reach new audiences, generate sales, or just figure out what’s actually working on Instagram right now, these statistics will show you where the platform is headed and what matters for your strategy.

Let’s get into it.

Table of contents

General Instagram stats

1. Instagram has 3 billion monthly active users

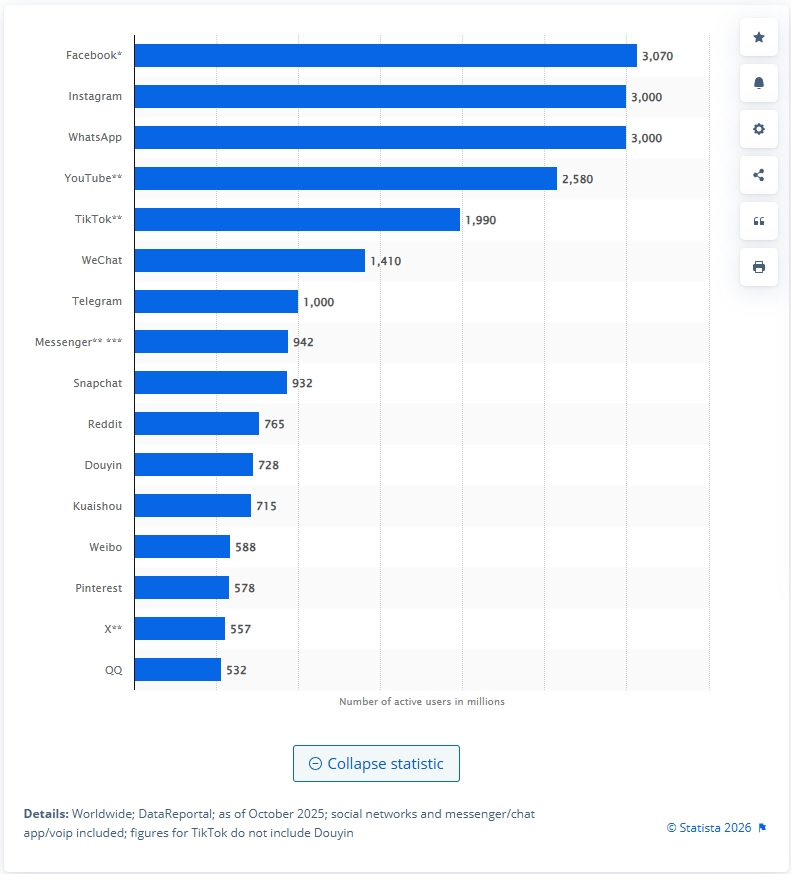

Instagram hit 3 billion monthly active users in 2025, making it the second-largest social network globally alongside WhatsApp.

The platform added 1 billion users since 2021, reaching this milestone faster than most social networks in history, and with that many people scrolling every day, there’s more than enough opportunity for brands and creators to grow their reach.

2. Ad impressions across Meta’s Family of Apps increased 14% year-over-year

Ad impressions grew 14% in Q3 2025 across Facebook, Instagram, Messenger, and WhatsApp, with Instagram driving significant portions of the increase.

The jump means more opportunities for your content to reach users through both paid and organic reach, correlating with increased time spent on platform and expanded ad inventory as Meta continues adding placement options across Reels, Stories, and Feed.

3. Average price per ad increased 10% year-over-year

Ad prices increased 10% in Q3 2025, signaling strong advertiser demand as marketers bid more aggressively when they see positive ROI.

For your marketing strategy, this increase means you’ll need better creative quality and sharper targeting to maintain cost efficiency, while making organic reach even more valuable as paid advertising costs continue climbing.

Instagram demographic statistics

4. Men aged 25-34 account for 18.4% of Instagram’s global ad audience

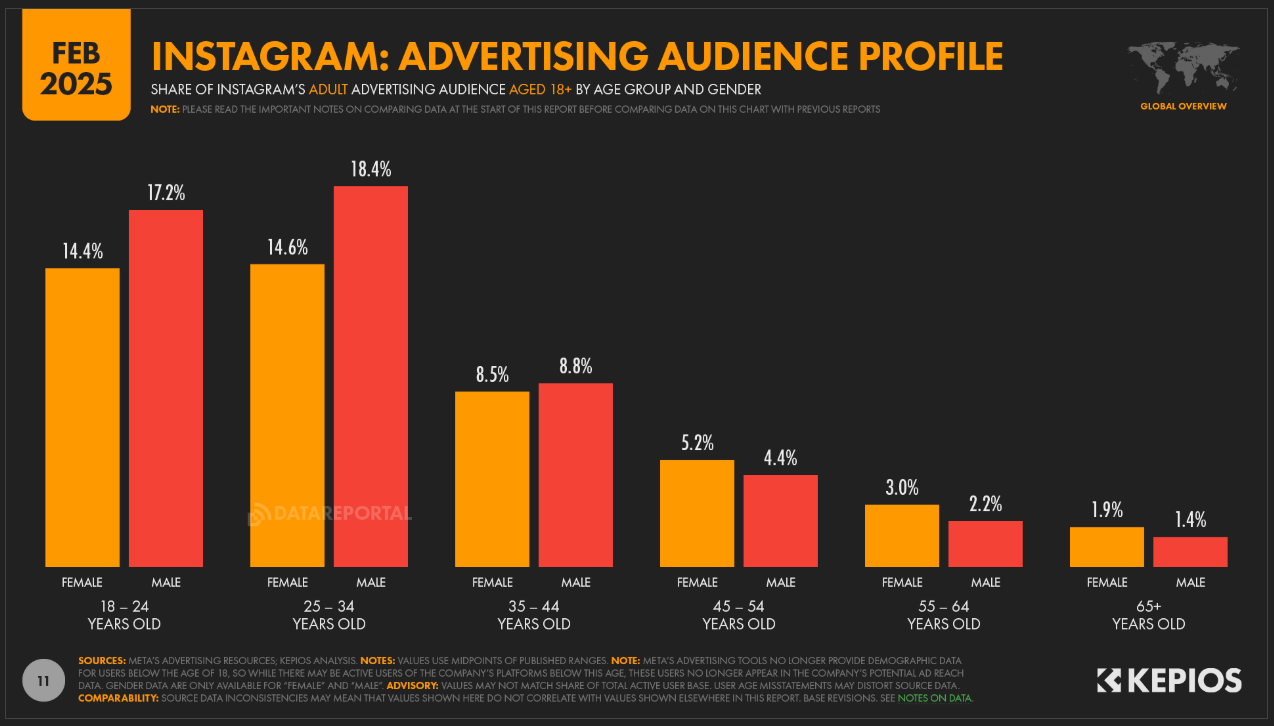

Men aged 25-34 make up 18.4% of Instagram’s global ad audience as of January 2025, making this the single largest age and gender segment on the platform.

These aren’t teenagers scrolling between classes—they’re working professionals with disposable income and active purchasing behavior who often serve as decision-makers or key influencers for B2B marketers targeting this demographic.

5. Instagram’s gender split is 52.5% male and 46.5% female globally

Instagram’s global audience is 52.5% male and 46.5% female, making it one of the most gender-balanced social platforms. While regional variations matter significantly and you should check your specific market data, this global balance means Instagram works effectively for brands targeting either gender, unlike platforms that skew heavily in one direction.

6. In the US, Instagram’s ad audience is 54.5% female and 44.6% male

In the US market, Instagram’s audience is 54.5% female and 44.6% male, revealing that the gender distribution actually flips in America compared to global averages.

Your visual style, influencer partnerships, and product focus should acknowledge this US female majority, though this doesn’t mean ignoring male users—rather recognizing the actual composition of your potential reach in American markets.

7. Men aged 18-24 represent 17.2% of Instagram’s ad audience

Men aged 18-24 make up 17.2% of Instagram’s ad audience, making this the second-largest demographic segment. When combined with the 25-34 male group, men under 35 account for over a third of total reach.

They’re more likely to be students or early-career professionals with different spending patterns and content preferences than older users, and these younger demographics often discover and popularize new content formats before other age groups adopt them.

8. Women aged 25-34 represent 14.6% of Instagram’s ad audience

Women aged 25-34 make up 14.6% of Instagram’s ad audience, and when combined with women aged 18-24, women under 35 represent nearly 30% of Instagram’s advertising reach.

This demographic has significant purchasing power and influences household buying decisions across multiple categories, making them a primary focus for brands in fashion, beauty, wellness, home goods, or parenting who want to reach decision-makers with real spending authority.

9. 62% of U.S. teens aged 13-17 use Instagram

62% of US teens aged 13-17 use Instagram, with usage increasing dramatically by age—72% of teens aged 15-17 use Instagram compared to just 43% of those aged 13-14.

Teen girls are also more likely than boys to use the platform, with 66% of girls versus 56% of boys reporting regular use, which shows clear gender preferences emerging even in younger demographics.

Instagram usage statistics

10. 50% of U.S. adults use Instagram

Half of American adults actively use Instagram, making it the third most popular platform behind YouTube at 84% and Facebook at 71%. Usage skews significantly younger with 80% of Americans aged 18-29 using Instagram compared to just 19% of those 65 and older.

11. 26% of Instagram users say keeping up with politics is a reason they use it

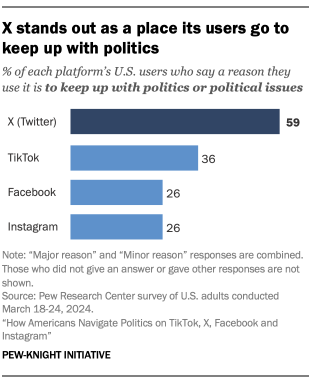

About one in four Instagram users cite keeping up with politics as a reason for using the platform. This is significantly lower than X/Twitter where 59% cite politics as a reason for use, but higher than users might expect, with about 36% of Instagram users saying at least some of what they see on the platform involves politics or political issues.

Instagram Reel statistics

12. Reels make up 50% of time spent on Instagram

Reels now account for half of all time users spend on Instagram, meaning people spend as much time watching Reels as they do browsing Feed and checking Stories combined.

When half of user time flows to one format, it shows where attention truly concentrates, which means if you’re not creating Reels, you’re essentially invisible during nearly half of every user’s Instagram session.

Track your Reels performance with Instagram analytics tools to see which content resonates most with your audience.

13. Video time spent on Instagram increased more than 30% year-over-year

Video time spent increased over 30% year-over-year in Q3 2025, demonstrating accelerating adoption of video formats as users spend more time watching video content.

Static images are steadily losing attention share, which validates Instagram’s strategic pivot to video-first experiences and suggests this trend will only continue growing stronger. Building a consistent Instagram content planning strategy around video helps you stay ahead of this shift.

14. Reels reached a $50 billion annual run rate

Reels hit a $50 billion annual run rate, meaning Reels now generate approximately $12.5 billion in quarterly ad revenue.

This massive monetization validates that both users and advertisers have fully embraced the format, and if paid advertisers are seeing strong enough performance to generate $50 billion annually, it’s a clear signal that your organic Reels content should be a strategic priority for reaching and engaging your audience.

15. Over 50% of Instagram ads ran on Reels in 2025, up from 35% in 2024

More than half of Instagram ads ran on Reels in 2025, up dramatically from 35% in 2024. The jump demonstrates that Reels ads significantly outperform traditional feed ads, and since advertisers optimize ruthlessly based on ROI data, your organic content strategy should align with where marketers are seeing the strongest performance and directing their budgets.

16. In the US, Reels account for 46% of time spent on Instagram

US users spend 46% of their Instagram time watching Reels, meaning nearly half of American user attention goes to this single format. Even with TikTok’s strong presence in the US market, Instagram Reels still captures 46% of user time.

This proves the format successfully competes for attention and means that for US-focused brands, Reels absolutely must be central to your content strategy if you want to reach American audiences where they’re actually spending their time.

Instagram Story statistics

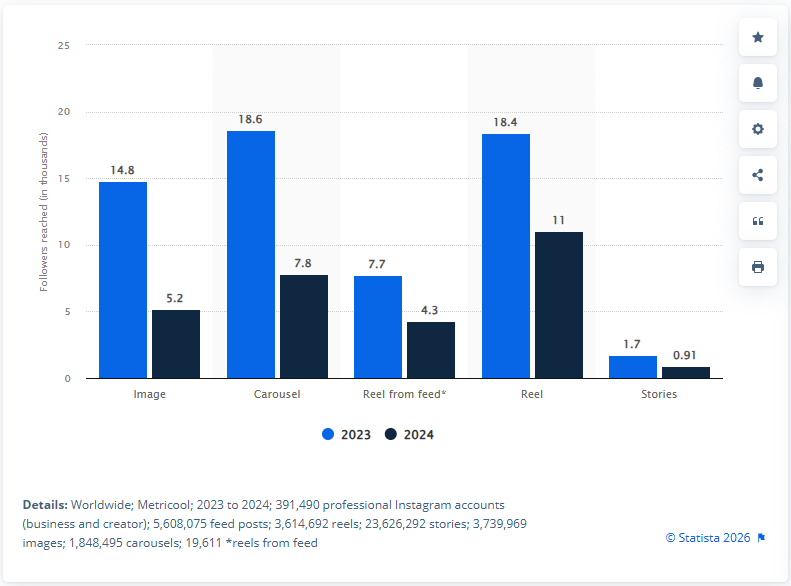

17. Stories reached an average of 910 users per post in 2024

Stories reached an average of 910 users per post in 2024, representing a significant 46% decline from 1,700 users in 2023. Despite this lower reach compared to previous years, Stories remain valuable for engaging your existing follower base, working best for behind-the-scenes content and time-sensitive updates rather than broad audience growth strategies that Reels handle more effectively.

Instagram advertising statistics

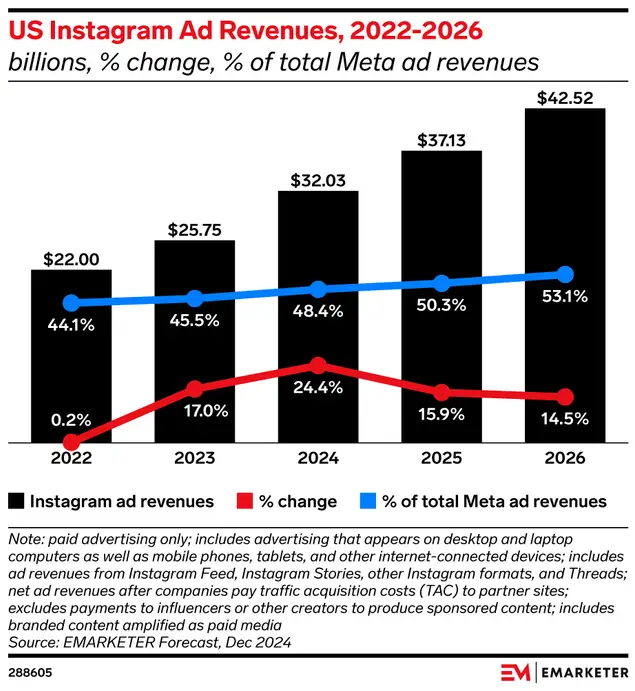

18. Instagram generated $70.9 billion in ad revenue in 2024

Instagram generated $70.9 billion in ad revenue in 2024, a substantial 16% increase from 2023’s $61.1 billion. Advertisers don’t invest $70.9 billion in a platform that doesn’t deliver measurable returns, and this growth demonstrates that Instagram isn’t plateauing but actually expanding as an advertising platform, creating both new opportunities and increased competition for marketers trying to reach audiences there.

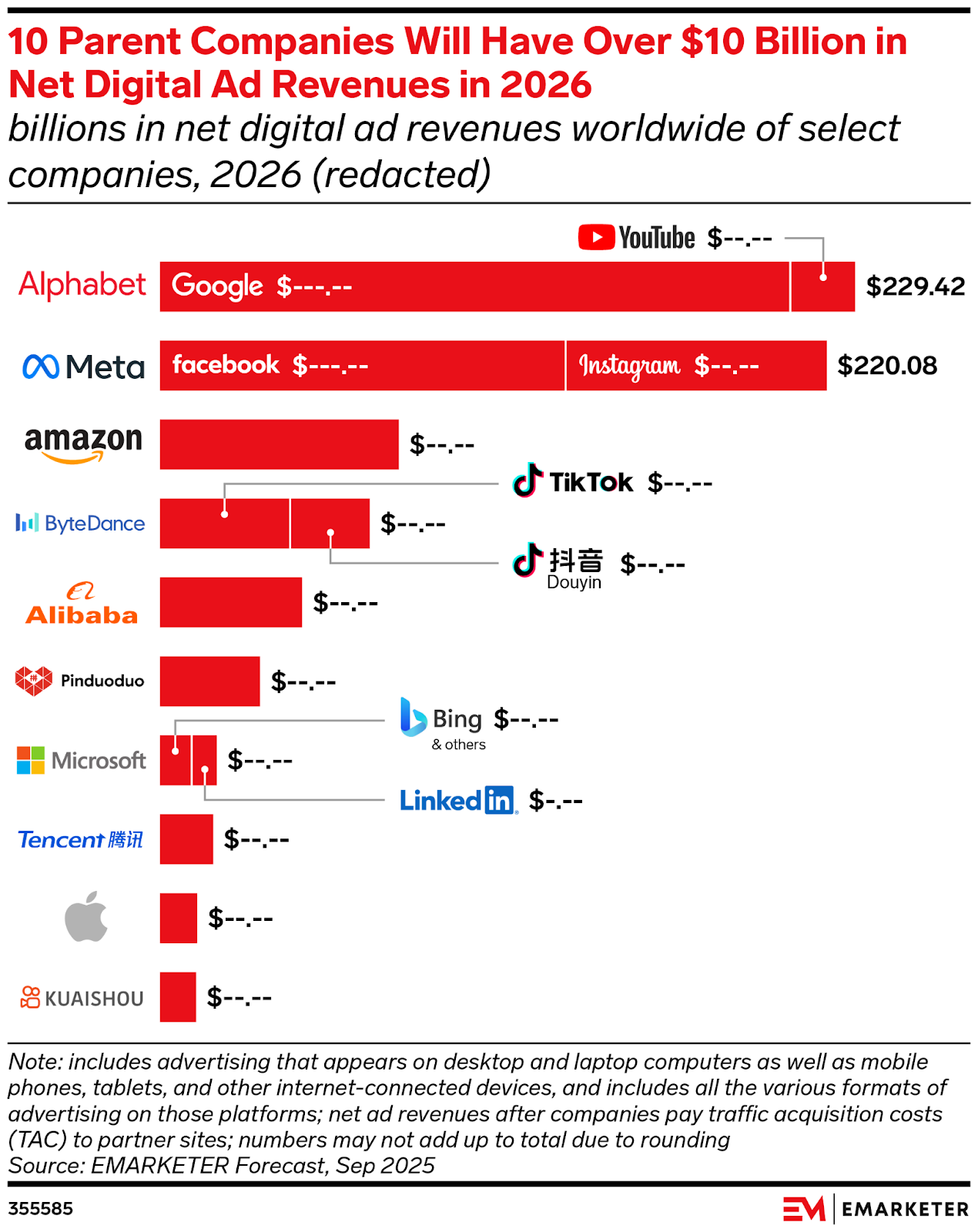

19. Facebook and Instagram combined will generate nearly $229 billion in ad revenue in 2026

Facebook and Instagram combined will bring in nearly $229 billion in ad revenue in 2026, nearly matching Google and YouTube’s combined $229.42 billion.

The gap between these two advertising giants has never been smaller in the 14 years eMarketer has tracked this data, demonstrating Meta’s sustained growth and the combined power of Facebook and Instagram as advertising platforms that compete directly with Google’s dominance in digital advertising.

20. Feed ads represent 53.7% of Instagram’s total ad revenue

Feed ads make up 53.7% of Instagram’s total ad revenue, meaning that despite the explosive rise of Reels, feed ads still generate the majority of Instagram’s advertising revenue.

For paid advertisers, this suggests feed ads should remain a core component of Instagram strategies alongside newer formats, and the enduring effectiveness of feed ads also benefits organic content creators by keeping the feed relevant in overall user behavior and platform priorities.

21. Stories ads represent 24.6% of Instagram’s ad revenue

Stories ads account for 24.6% of Instagram’s total advertising revenue, making Stories the second-largest ad revenue source behind feed ads.

That translates to more than $17 billion in annual revenue based on the 24.6% share, which reinforces for organic marketers that Stories aren’t just a casual, ephemeral format but actually function as a serious business tool that drives substantial commercial results.

22. Instagram US ad revenue reached $37.13 billion in 2025

Instagram’s US ad revenue hit $37.13 billion in 2025, a 15.9% increase over 2024. The US market alone generates nearly half of Instagram’s global ad revenue, meaning US brands face significantly more advertising competition than brands in other markets, making strong organic reach increasingly crucial for cost-effective marketing as paid advertising costs in the competitive American market continue rising faster than other regions.

Instagram influencer statistics

23. US Instagram influencer marketing spending will reach $3.17 billion in 2025

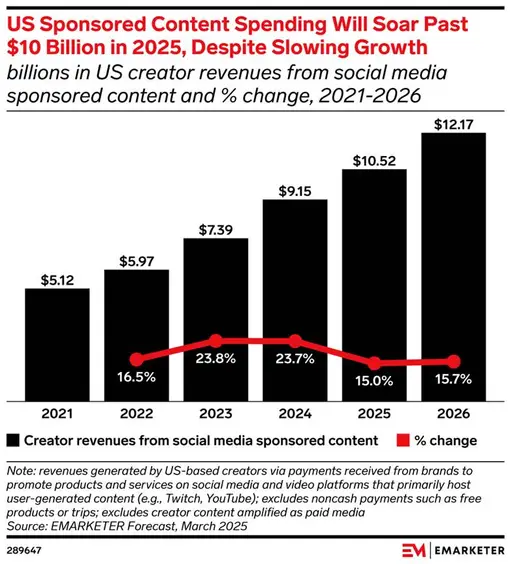

US influencer spending on Instagram will hit $3.17 billion in 2025, making Instagram the second-largest platform for influencer spending behind YouTube’s $3.45 billion and ahead of TikTok’s $1.19 billion. This represents 30.1% of the total $10.52 billion US influencer marketing market, and the fact that brands are directing billions specifically to Instagram creators proves the platform delivers measurable returns that justify these massive investments in creator partnerships.

24. Nano-influencers with 1,000-10,000 followers achieve 1.73% engagement rates

Nano-influencers achieve 1.73% engagement despite their smaller followings, while mega-influencers with 1 million+ followers only achieve 0.68% engagement.

That means nano-influencers deliver more than double the engagement rate, which explains why smart brands increasingly work with multiple smaller creators rather than betting everything on celebrity partnerships.

25. 62% of organizations selected Instagram as most integral platform for creator marketing

62% of organizations chose Instagram as their most integral platform for creator marketing. Even more telling, 60% reported Instagram drove the most ROI compared to other platforms, and 91% of creator marketing campaigns featured Instagram, demonstrating that Instagram isn’t just one option among many but the core platform where most brands see their strongest creator partnership results.

26. 75.9% of Instagram influencers are nano-influencers with 1,000-10,000 followers

Three out of four Instagram influencers are nano-influencers with 1,000-10,000 followers, with only 13.6% classified as micro-influencers and just 0.3% as macro or mega influencers.

This distribution means there’s an enormous pool of affordable nano-influencers available for partnerships, and since these creators achieve the highest engagement rates at the lowest costs, brands can build diverse creator networks that reach multiple niche audiences more effectively than single celebrity partnerships.

Instagram statistics for business

27. 96% of social-first brands say social commerce is high or very high priority

96% of social-first brands say social commerce is high or very high priority, showing near-universal recognition of its importance. However, only 39% report high ROI from social commerce, revealing a significant execution gap where brands recognize the importance but struggle with implementation, which means there’s a major opportunity for businesses that can bridge this gap between aspiration and actual performance.

28. Social-first brands achieved 10.2% average revenue increase from social strategies

Social-first brands saw 10.2% revenue growth as a direct result of putting social media at the center of their business strategy. These brands also report that 14.4% of their total B2C revenue now comes from social commerce channels, proving that treating social as an afterthought limits growth potential while strategic social integration drives real bottom-line results.

29. 61% of consumers discovered a new brand or product on social media in the past 12 months

Six in ten consumers discovered a new brand or product on social media in the past year, confirming that social platforms have become primary discovery engines where more than half of consumers find brands they’ve never heard of before.

Combined with the finding that 71% of consumers say their most recent social media purchase experience was good or excellent, this demonstrates that social commerce delivers satisfying end-to-end experiences that convert discovery into completed transactions.

30. 78% of marketers worldwide used Instagram for marketing in early 2025

That’s nearly four out of five marketers who are using Instagram in early 2025, making it the second most popular platform among marketers globally. Instagram trails only Facebook at 83% and outpaces LinkedIn at 69%, YouTube at 53%, and TikTok at 26%.

Use these Instagram statistics in your strategy

These statistics paint a clear picture: Instagram in 2026 is a video-first platform where Reels dominate user attention and advertiser budgets. The 25-34 demographic drives the most engagement, while teens and young adults continue adopting the platform at high rates. With 3 billion users worldwide and ad prices climbing 10% year-over-year, brands need smarter strategies to stand out.

The takeaway isn’t to chase every trend. Instead, focus on what the data shows works: Reels capture 50% of user time, Stories maintain strong engagement with existing followers, and feed content still drives the majority of ad revenue. Your demographic composition matters more than global averages, so analyze your specific audience before committing resources.

Ready to put these insights into action? Try Vista Social free to schedule Reels and Stories in advance, track performance with detailed analytics, and manage multiple Instagram accounts from one dashboard. When the data clearly shows video content driving results, the right tools make consistent execution possible.

Try Vista Social for free

A social media management platform that actually helps you grow with easy-to-use content planning, scheduling, engagement and analytics tools.

Get Started NowAbout the Author

Content Writer

Russell Tan is a content marketing specialist with over 7 years of experience creating content across gaming, healthcare, outdoor hospitality, and travel—because sticking to just one industry would’ve been boring. Outside of her current role as marketing specialist for Vista Social, Russell is busy plotting epic action-fantasy worlds, chasing adrenaline rushes (skydiving is next, maybe?), or racking up way too many hours in her favorite games.

Read with AI

Save time reading this article using your favorite AI tool

Summarize with AI

Never Miss a Trend

Our newsletter is packed with the hottest posts and latest news in social media.

You have many things to do.

Let us help you with social media.

Use our free plan to build momentum for your social media presence.

Or skip ahead and try our paid plan to scale your social media efforts.

P.S. It will be a piece of cake 🍰 with Vista Social

Subscribe to our Newsletter!

To stay updated on the latest and greatest Social Media news. We promise not to spam you!

Enjoyed the Blog?

Hear More on Our Podcast!

Dive deeper into the conversation with industry insights & real stories.